This month’s report provides a comprehensive overview of the local housing and rental markets, highlighting key trends and valuable insights for buyers, sellers, and renters. The real estate landscape in Coatesville Area School District continues to evolve, presenting both continuities and shifts from the previous month. While the market remains competitive, we're observing some adjustments in pace and pricing dynamics.

In this report, we’ll break down essential market indicators such as median and average sales prices, sale price-to-original price ratios, and financing trends. We’ll also delve into the rental market, offering a snapshot of rental properties that have been occupied. Understanding these trends is crucial in today’s dynamic environment. Whether you're looking to buy, sell, lease, or invest, or simply stay informed, these insights may help you better understand the competitive Coatesville Area School District real estate landscape. To understand how these trends impact your specific real estate goals, call Trago Realty today for a personalized consultation.

The Coatesville Area School District housing market in June continued to show strong activity, albeit with some interesting shifts compared to May.

Sales Market Dynamics:

The median days on market saw an increase, reaching 13 days in June, up from a very rapid 6 days in May. This suggests a slight cooling in the immediate urgency of sales, although not much, offering buyers a bit more breathing room. The sale price-to-original price ratio, a key indicator of market competitiveness, edged down to 100.70% in June from May’s robust 101.50%. While still indicating that homes are selling very close to or slightly above their asking price on average, it’s a subtle shift from the higher premiums seen in May.

A more notable change is observed in price reductions. The number of properties undergoing price reductions increased significantly to 34 in June, a considerable jump from just 8 in May. For these properties, the adjusted reduced price-to-original ask ratio averaged 92.46% (down from 95.94% in May), and the median was 96.61% (a slight decrease from 96.72% in May). This suggests that while the overall market remains strong, some sellers are adjusting expectations, particularly on properties that may have been initially overpriced.

The months’ supply of inventory held steady at 3 months in June, matching May’s figure. While still indicating a seller’s market, this stability suggests a consistent, albeit tight, supply of homes.

Financing Trends:

Conventional financing remained the dominant payment method, accounting for 60.94% of transactions in June, a slight decrease from 63.16% in May. Cash purchases saw a modest increase, making up 20.31% of sales (up from 19.30% in May). Other financing types included VA (9.38%) and FHA (7.81%), with a small percentage (1.56%) noted for "Cash, Conventional" indicating hybrid financing. As always, this financing information is self-reported by the listing agents; therefore, it may reflect how the purchase agreement was structured but is not necessarily guaranteed of how the final financing occurred at settlement.

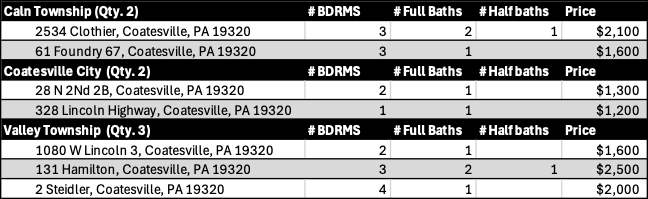

The rental market in Coatesville Area School District continues to offer various options across different municipalities. For those not ready to buy, or looking for flexible living solutions, the rental market remains a vital part of the housing landscape. Properties are available across different sizes and price points, catering to diverse needs.

Here's a glimpse into some of the rental properties closed in June 2025:

Rental Properties Occupied in June 2025:

Caln Township

Coatesville City

Valley Township

The Coatesville Area School District residential real estate market was very active in June 2025. Below are key statistics for the month, with comparisons to May 2025 data:

Below is a breakdown of financing types for closed sales in June 2025:

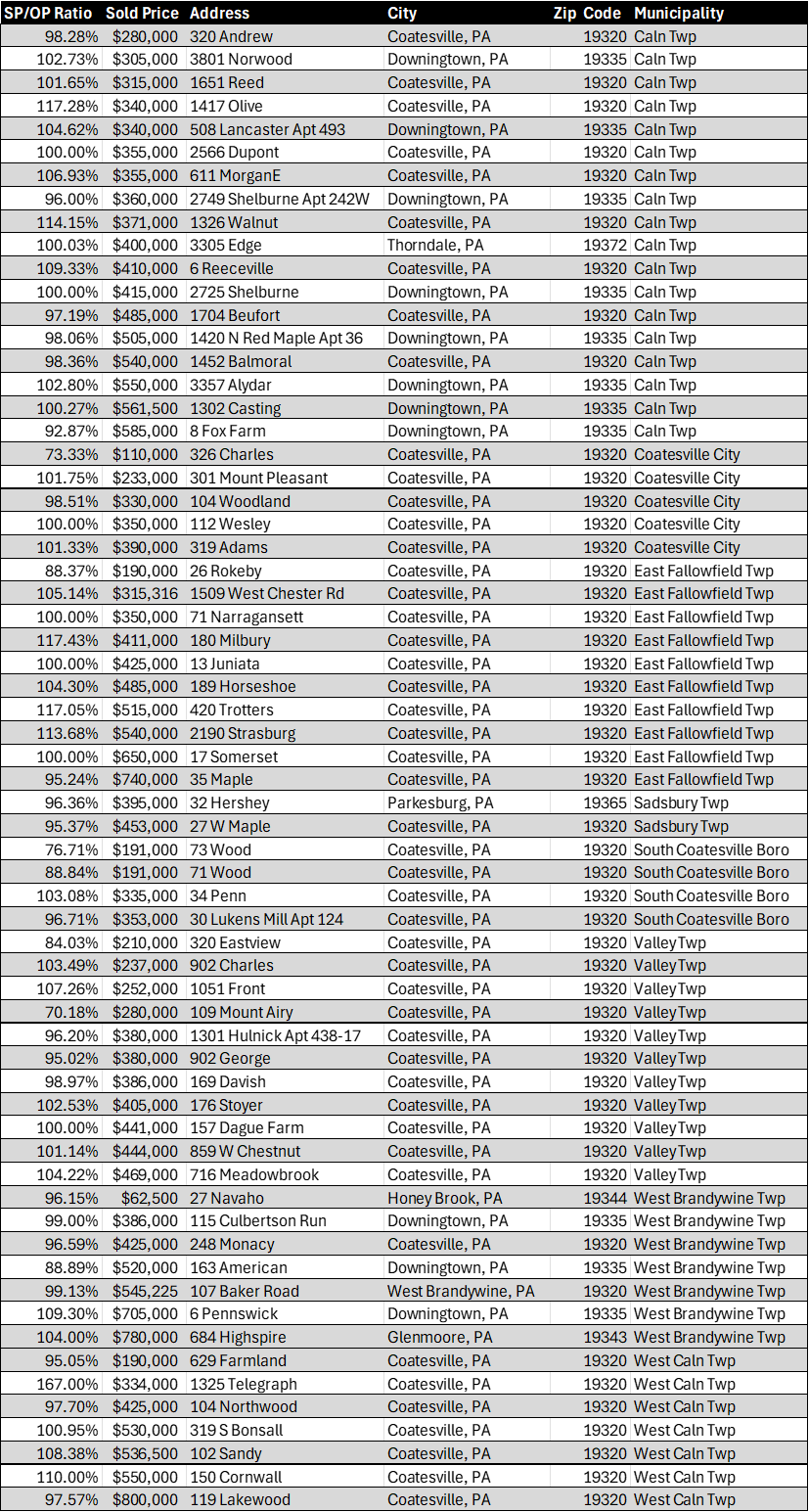

Below is a list of closed transactions in Coatesville Area School District for June 2025, including their sale-to-list price ratios, sale prices, and locations.

Caln Twp

Coatesville City

East Fallowfield Twp

Sadsbury Twp

South Coatesville Borough

Valley Twp

West Brandywine Twp

West Caln Twp

If you like what you see...

https://www.tragorealty.com/#subscribe

The key market overview statistics are presented in the bulleted list above. For a visual representation or a PDF version of this data, please reach out.

All information in this report has been collected from Bright MLS and is deemed reliable but not guaranteed. The Broker makes no representations or warranties, express or implied, regarding the accuracy, completeness, or reliability of the data provided. This information is subject to errors, omissions, and data entry inaccuracies, including but not limited to those from cooperating brokers participating in Bright MLS. Additionally, this report does not account for off-market transactions, private sales, or transactions conducted outside of Bright MLS.

This report is for informational purposes only and should not be construed as real estate advice. Individual circumstances vary, and real estate decisions should be based on professional guidance tailored to your specific situation. Please contact Trago Realty or your real estate agent to discuss your particular situation and/or needs.