December 17, 2025

November 2025 Chester County, PA Residential Real Estate Market Update

📊 Quick Market Snapshot: November 2025

- Months Supply of Inventory: 3 months (Stable from 3 months in October 2025)

- Average Days on Market: 26 days (Stable from 26 days in October 2025)

- Sale Price-to-Original Price Ratio (SP/OP):

- Average: 101.13% (Up from 99.21% in October 2025)

- Median: 100% (Stable from 100.00% in October 2025)

- Insight: The sharp improvement in the Average SP/OP Ratio and the reduced days on market suggest that properties that were priced correctly moved swiftly and efficiently in November.

The November market in Chester County experienced the anticipated seasonal slowdown in transaction volume. However, the month was defined by a remarkable stability in pricing and an increased efficiency in sales velocity, suggesting that committed buyers and sellers are acting decisively as the year closes.

Market Insights: November 2025 Chester County Real Estate Report

Key Market Metrics:

- Number of Closed Sales: 348 (Down significantly from 479 in October 2025)

- Current Price Average: $783,893 (Up from $775,746 in October 2025)

- Current Price Median: $570,000 (Down slightly from $580,000 in October 2025)

- Cumulative Days on Market (CDOM) Average: 30 days (Down from 37 days in October 2025)

- Cumulative Days on Market (CDOM) Median: 10 days (Stable from 10 days in October 2025)

- Number of Price Reductions: 247 (Down from 342 in October 2025)

- Median Percentage Price Reduction: 4.47% (Down from 5.34% in October 2025)

Comparison to October 2025

November saw a clear seasonal dip in sales volume, but the quality and speed of transactions improved significantly:

- Closed Sales Volume: Sales dropped to 348 units, a predictable decrease as the market slows for the holidays.

- Pricing: The Average Price increased to $783,893, while the Median Price softened slightly to $570,000. This suggests that while there were fewer overall sales, the high-end luxury market maintained strong pricing power.

- Negotiation Nuance: The Average SP/OP Ratio jumped to 99.80%, a major positive indicator showing sellers secured prices much closer to their ask than last month. While the Median Ratio dipped just below 100%, the overall trend is toward less negotiating room for buyers.

- Market Velocity: The CDOM Average dropped by seven days to 30 days, signaling that older, lingering inventory finally moved or was pulled, leaving a healthier, faster-moving selection of properties. The Median CDOM holding at 10 days confirms fresh, desired inventory moves at lightning speed.

- Price Reductions: The number of reductions fell by nearly 100 listings, and the depth of the typical reduction decreased. This is strong evidence that pricing is becoming more accurate and the market is more efficient.

Mortgage & Payment Types (November 2025)

Financing trends in November reinforced the market's reliance on highly liquid buyers, with Cash transactions surging compared to last month (27.17% vs. 21.71% in October), often giving these buyers an edge in competition.

- Conventional: 290 units (66.21%)

- Cash: 119 units (27.17%)

- VA: 10 units (2.28%)

- Other/Minor Financing Types: 19 units (4.34%) (Includes FHA, ARM, Private, PHFA, and multi-type financing)

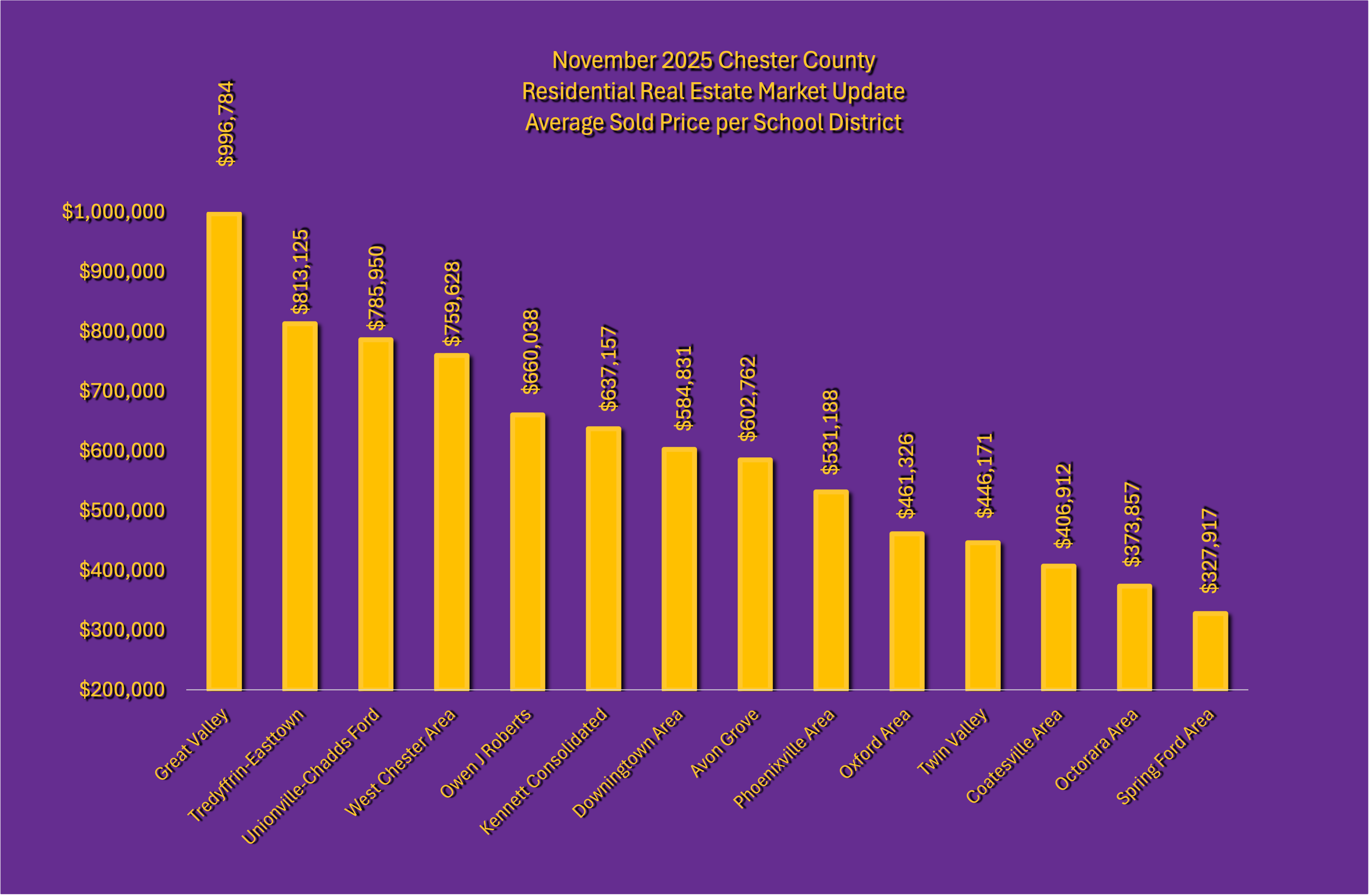

November 2025 Chester County by School District: Summary Data

The ranking of school districts by average sold price remained consistent, with the ultra-luxury markets of Great Valley and Tredyffrin-Easttown leading the county.

- Great Valley: Average Sold Price: $996,784

- Tredyffrin-Easttown: Average Sold Price: $813,125

- Unionville-Chadds Ford: Average Sold Price: $785,950

- West Chester Area: Average Sold Price: $759,628

- Owen J Roberts: Average Sold Price: $660,038

- Kennett Consolidated: Average Sold Price: $637,157

- Downingtown Area: Average Sold Price: $602,762

- Avon Grove: Average Sold Price: $584,831

- Phoenixville Area: Average Sold Price: $531,188

- Oxford Area: Average Sold Price: $461,326

- Twin Valley: Average Sold Price: $446,171

- Coatesville Area: Average Sold Price: $406,912

- Octorara Area: Average Sold Price: $373,857

- Spring Ford Area: Average Sold Price: $327,917

November 2025 Residential Sales by School District and Township

Luxury Markets (Average SP/OP Ratio above 100%)

- Tredyffrin-Easttown: Average SP/OP Ratio: 101.41% | Led by Easttown Township, where homes sold for an average of 4.35% over asking.

- West Chester Area: Average SP/OP Ratio: 100.83% | West Goshen and East Goshen Townships both showed an average of over 1.25% above asking.

- Owen J Roberts: Average SP/OP Ratio: 101.05% | Strong price retention across the district.

- Coatesville Area: Average SP/OP Ratio: 102.95% | The highest price retention in the county, driven by aggressive sales in West Caln and West Brandywine Townships.

High Velocity Markets (Average CDOM 30 days or less)

- West Chester Area (20 days): Maintained exceptional speed across its townships.

- Owen J Roberts (20 days): Fast-moving market with low days on market.

- Tredyffrin-Easttown (24 days): Still selling quickly despite high price points.

- Phoenixville Area (23 days): Strong demand kept average days on market low.

High-Value Pockets by Township (Selected)

- Willistown Township (Great Valley): Average Sold Price: $1,372,538

- Easttown Township (Tredyffrin-Easttown): Average Sold Price: $1,150,720

- West Pikeland Township (Downingtown Area): Average Sold Price: $1,215,333

Summary & Outlook

November demonstrated that while the overall volume decreased, the underlying strength of the Chester County residential market is sound. The improvements in both the Average SP/OP Ratio and the Average CDOM are clear evidence of a more efficient, less congested market compared to October. The significant jump in cash buyers (27.17% of transactions) suggests that the market remains highly liquid and competitive for sellers who value speed and certainty.

- For Sellers: The data suggests that buyers are ready to pay full price or more for accurately valued homes. Listing inventory now, while competition is low, can yield fast results.

- For Buyers: The increase in sales efficiency means the market is less forgiving for low offers. However, the slight drop in the Median Sold Price offers targeted opportunities in the mid-range market.

Please feel free to reach out if you have any questions or would like a more detailed analysis of specific areas.

If you like what you see...

✅ Sign up for our Newsletter to stay updated on next month’s market trends!

✅ Explore other November 2025 Market Reports:

Data Disclaimer & Disclosure

All information is deemed reliable but not guaranteed for accuracy or completeness. All data and statistics are provided by Bright MLS for the period of November 2025.

The Broker makes no warranties or representations, express or implied, regarding the accuracy or reliability of this data, whether collected directly or provided by Bright MLS or its participants. This information is subject to errors, omissions, and inaccuracies, including, but not limited to, those from data entry. Additionally, this report does not account for off-market transactions, private sales, or transactions conducted outside of Bright MLS. This report is for informational purposes only and should not be construed as real estate advice. Since individual circumstances vary, all real estate decisions should be based on professional guidance tailored to your specific situation. Please contact Trago Realty or your real estate agent to discuss your particular needs.