December 16, 2025

November 2025 Chester County Residential Rental Market Update

📊 Quick Market Snapshot

November 2025 Chester County Residential Rental Market Update

- Total Units Leased: 121 (Down from 133 in October 2025)

- Countywide Rents (Estimated): Average: $2,427 & Median: $2,400 (Up from $2,300 in October 2025)

- Sale Price-to-Original Price Ratio (Median): 100.00% (Up from 96.60% in October 2025)

- Days on Market (CDOM): Average: 47 days (Down from 52 days in October 2025)

- Days on Market (CDOM): Median: 35 days (Down from 42 days in October 2025)

Welcome to the Trago Realty market update for the Chester County Residential Rental Market. This report summarizes residential leasing activity across the entire county during November 2025, comparing the key performance indicators to October.

The November market showed a continued seasonal slowdown in volume but offered tenants quicker options. The leasing pace increased significantly, with fewer days on market, but the overall sales-to-list ratio confirms that landlords are generally securing leases by offering small concessions on price.

Countywide Overview – November 2025

- Total Units Leased: 121 (Volume dipped slightly from 133 units in October.)

- Median Rent (Estimated): $2,400 (Slight increase, suggesting strong demand for median-priced rentals.)

- Median SP/OP Ratio: 100.00% (A significant jump, indicating the median rental secured its asking price this month.)

- Median Days on Market: 35 days (A quicker pace than October's 42 days, confirming that tenant decision-making time has shortened.)

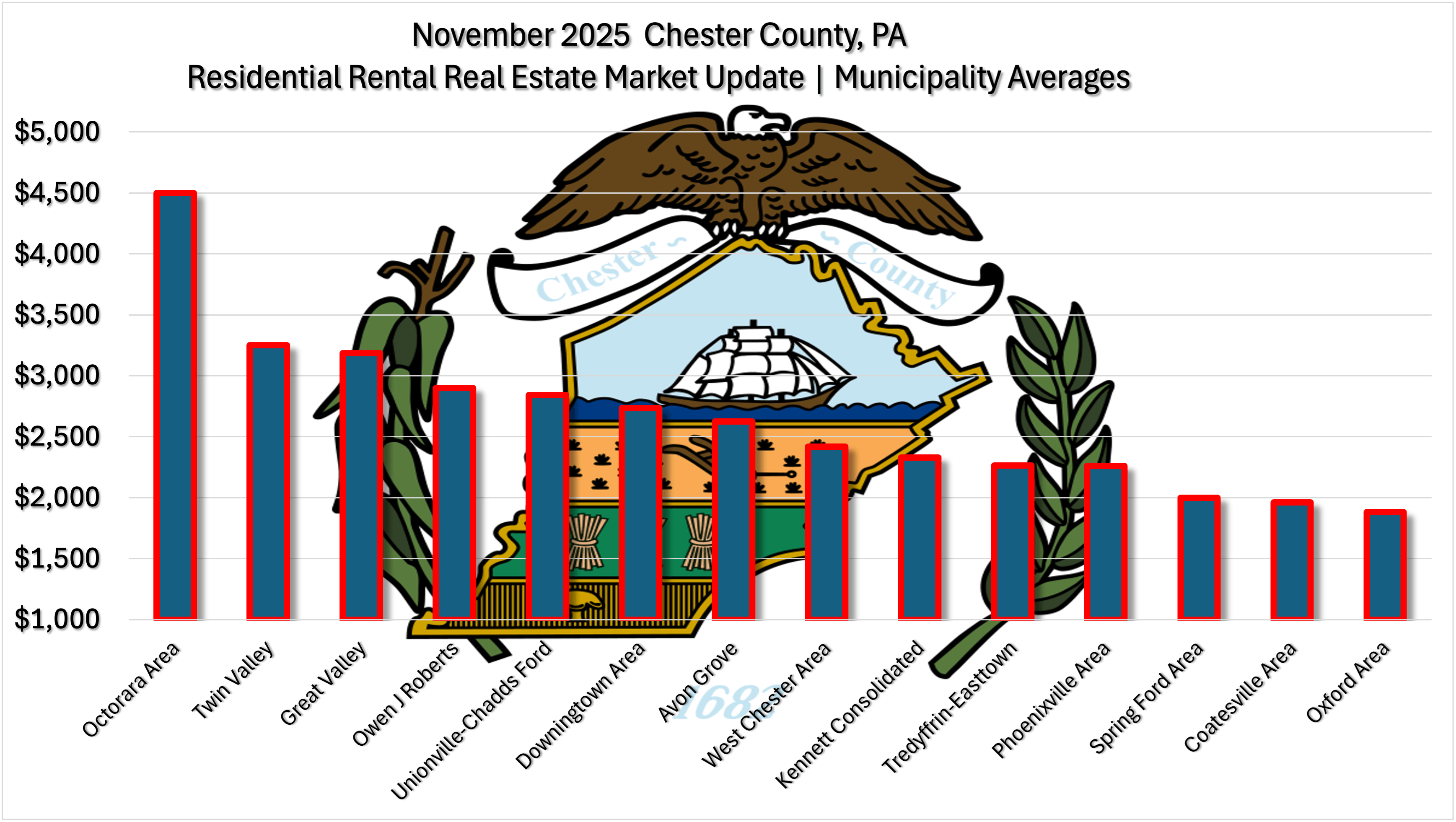

School District Performance

School District Overview

Highlights:

- Phoenixville Area remained the highest volume market, leasing 35 units, followed by West Chester Area and Downingtown Area.

- Octorara Area commanded the highest average rent at $4,500 based on a low volume sale, while Great Valley sustained a very high average rent of $3,185 across 14 units.

- The market velocity improved across the board, with the county Median CDOM dropping by seven days.

District Breakdown (Ranked by Average Rent):

- Octorara Area – 1 unit – Average Rent: $4,500

- Twin Valley – 1 unit – Average Rent: $3,250

- Great Valley – 14 units – Average Rent: $3,185

- Owen J. Roberts – 4 units – Average Rent: $2,900

- Unionville-Chadds Ford – 2 units – Average Rent: $2,843

- Downingtown Area – 22 units – Average Rent: $2,737

- Avon Grove – 2 units – Average Rent: $2,625

- West Chester Area – 23 units – Average Rent: $2,420

- Kennett Consolidated – 12 units – Average Rent: $2,329

- Tredyffrin-Easttown – 16 units – Average Rent: $2,264

- Phoenixville Area – 35 units – Average Rent: $2,260

- Spring-Ford Area – 5 units – Average Rent: $1,999

- Coatesville Area – 14 units – Average Rent: $1,960

- Oxford Area – 3 units – Average Rent: $1,883

School District-to-Township Breakdown

Below are the median rental prices and market metrics by township for several key school districts, reflecting localized variations.

Downingtown Area (22 units, Average Rent $2,737)

- This district saw a higher average rent than the county median, showing strong, sustained demand for its sub-markets.

- Median CDOM for DASD: 35 days, matching the county median.

West Chester Area (23 units, Average Rent $2,420)

- A key volume leader, the average rent here remains slightly above the county median, appealing to a broad segment of renters.

- Median CDOM for WCASD: 26 days, significantly faster than the county median, indicating high velocity.

Tredyffrin-Easttown (16 units, Average Rent $2,264)

- A high-demand school district whose average rent is now slightly below the county average, potentially due to a mix of apartment and single-family leases this month.

Great Valley (14 units, Average Rent $3,185)

- One of the most expensive rental markets in the county, driven by demand for premier properties in townships like Malvern and East Whiteland.

Observations & Summary

November marked a shift toward a faster, cleaner rental market compared to the negotiation-heavy atmosphere in October.

- Market Velocity: The drop in the Median CDOM from 42 days to 35 days is the most positive sign for landlords, indicating that rental listings are converting to leases more quickly.

- Negotiation Power: The jump in the Median SP/OP Ratio back to 100.00% confirms that the typical landlord is no longer needing to discount the asking price to secure a tenant. This suggests appropriately priced inventory is leasing quickly and without concession.

- Inventory: The market holds approximately 3 months of inventory, a healthy level that offers tenants choice while ensuring listings do not languish indefinitely.

Key Takeaways:

The rental market is exiting its seasonal slowdown with increased speed and improved price retention for landlords. Tenants should be prepared to act quickly, as the median decision time has shortened considerably.

Stay Connected

✅ Sign up for our Newsletter to stay updated on next month’s market trends!

✅ Explore other November 2025 Market Reports:

Data Disclaimer & Disclosure

All information is deemed reliable but not guaranteed for accuracy or completeness. All data and statistics are provided by Bright MLS for the period of November 2025.

The Broker makes no warranties or representations, express or implied, regarding the accuracy or reliability of this data, whether collected directly or provided by Bright MLS or its participants. This information is subject to errors, omissions, and inaccuracies, including, but not limited to, those from data entry.

Additionally, this report does not account for off-market transactions, private sales, or transactions conducted outside of Bright MLS. This report is for informational purposes only and should not be construed as real estate advice. Since individual circumstances vary, all real estate decisions should be based on professional guidance tailored to your specific situation. Please contact Trago Realty or your real estate agent to discuss your particular needs.